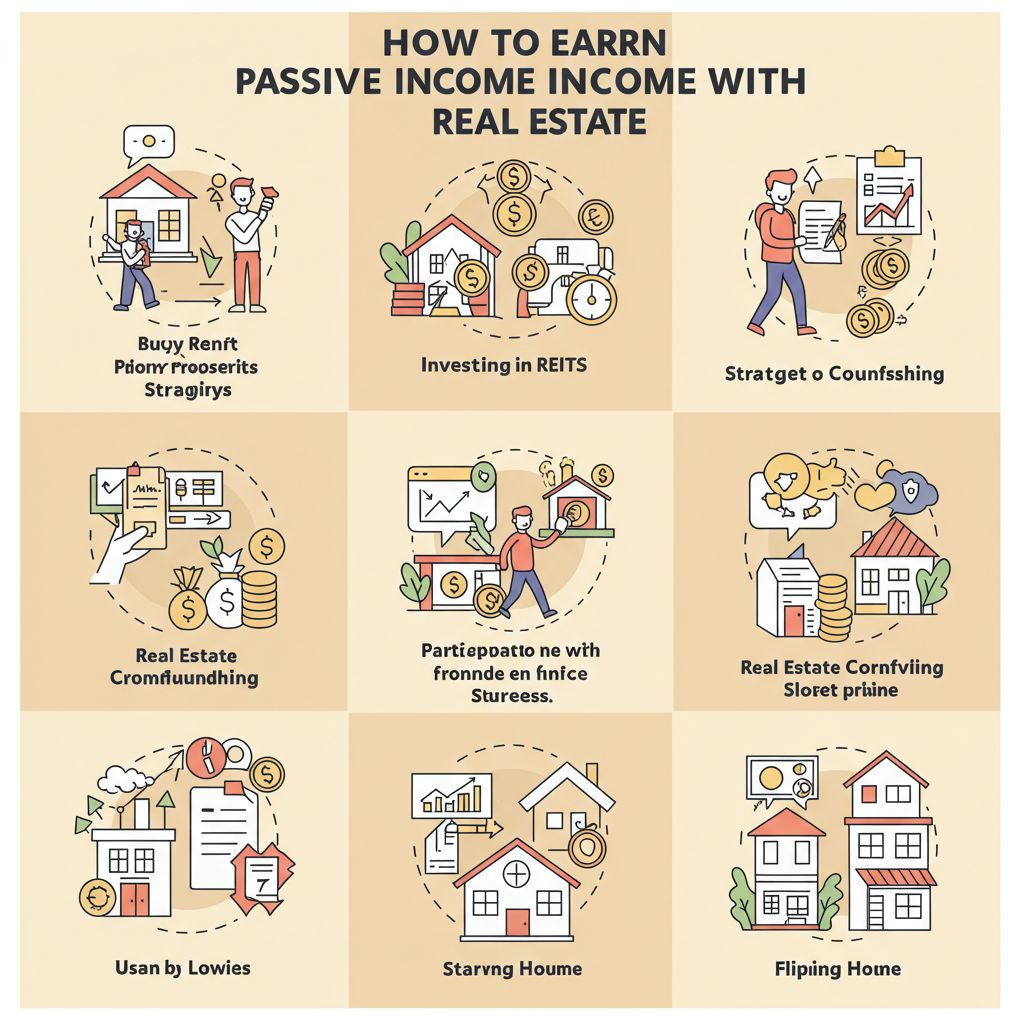

In today’s fast-paced world, finding ways to earn passive income is becoming increasingly essential for financial security and independence. Real estate has long been considered one of the best avenues for generating passive income, providing not only cash flow but also potential appreciation in value over time. Whether you’re a seasoned investor or just starting, this guide will explore various strategies for earning passive income through real estate investments.

Unlocking passive income through real estate investments can be a transformative venture for many. With the right strategies and understanding of the market, individuals can create sustainable income streams that contribute to long-term financial stability. To illustrate innovative concepts in this realm, you might consider visual tools like explore newspaper mockup designs.

Understanding Passive Income

Passive income refers to earnings derived from a rental property, limited partnership, or other enterprise in which a person is not actively involved. For real estate, this typically means purchasing properties that generate regular cash flow without requiring constant management. Examples include:

- Rental properties

- Real Estate Investment Trusts (REITs)

- Real estate crowdfunding

- Partnering in a real estate venture

Types of Real Estate Investments

Before diving into passive income strategies, it’s crucial to understand the various types of real estate investments available:

1. Rental Properties

Owning rental properties is one of the most traditional methods of generating passive income. You can invest in:

- Single-family homes

- Multi-family units

- Commercial properties

These properties can provide monthly rental income after covering expenses such as mortgage payments, property management fees, and maintenance costs.

2. Real Estate Investment Trusts (REITs)

REITs allow investors to purchase shares of a company that owns or finances income-producing real estate. This is an excellent option for those looking to invest in real estate without the burden of property management. Advantages include:

- Liquidity: Shares can be bought and sold easily in the stock market.

- Diversification: Invest in a portfolio of properties across different sectors.

3. Real Estate Crowdfunding

This relatively new investment model allows individuals to pool their money to invest in real estate projects. It typically provides access to larger projects that individual investors couldn’t afford on their own.

Steps to Earning Passive Income Through Real Estate

Step 1: Educate Yourself

Before making any investments, it’s vital to acquire knowledge about the real estate market and specific strategies. Consider the following resources:

- Books on real estate investing

- Podcasts and online courses

- Networking with experienced investors

Step 2: Define Your Investment Goals

Clearly outline your goals, including:

- Desired income level

- Investment timeframe

- Risk tolerance

Step 3: Assess Your Financial Situation

Understanding your financial status is crucial for any investment. Evaluate your:

- Credit score

- Debt-to-income ratio

- Available capital for investment

Step 4: Research and Choose the Right Investment Type

Depending on your goals and resources, select an appropriate investment type. For example:

If you seek active management and high returns, rental properties may be suitable. However, if you prefer a hands-off approach, consider REITs or crowdfunding.

Step 5: Build a Strong Team

Successful real estate investing often requires a team of professionals, including:

- Real estate agent

- Property manager

- Accountant

- Legal advisor

Maximizing Revenue from Rental Properties

For those interested in rental properties, there are several strategies to maximize your income:

1. Location, Location, Location

Invest in properties located in high-demand areas to ensure consistent rental income. Key factors to consider include:

| Factor | Importance Level |

|---|---|

| Proximity to public transportation | High |

| Quality of local schools | High |

| Access to shopping and amenities | Medium |

2. Renovation and Upgrades

Investing in renovations can significantly increase the rental value of your property. Focus on:

- Kitchen and bathroom upgrades

- Energy-efficient appliances

- Landscaping improvements

3. Effective Property Management

A professional property management company can help mitigate the challenges of being a landlord. Key responsibilities include:

- Finding and screening tenants

- Handling repairs and maintenance

- Collecting rent

Tax Advantages of Real Estate Investment

Investing in real estate offers several tax benefits, including:

1. Deductible Expenses

Landlords can deduct certain expenses from their taxable income, such as:

- Mortgage interest

- Property taxes

- Repairs and maintenance

2. Depreciation

Real estate investors can benefit from depreciation deductions, which can offset income earned from the property over time.

3. 1031 Exchange

This process allows investors to defer capital gains taxes when selling one property and buying another, enabling reinvestment of profits without immediate tax implications.

Risks to Consider

While real estate can be a lucrative source of passive income, it’s important to recognize potential risks, such as:

- Market fluctuations affecting property values

- Vacancy rates leading to loss of rental income

- Legal and regulatory issues

Conclusion

Earning passive income through real estate is an attainable goal for anyone willing to invest time and resources in learning and strategically managing their investments. By understanding the various investment avenues, maximizing revenues, and mitigating risks, you can pave the way to a sustainable and profitable real estate portfolio. Remember, the journey to passive income is a marathon, not a sprint, so stay informed, be patient, and make informed decisions.

FAQ

What is passive income in real estate?

Passive income in real estate refers to earnings generated from rental properties or real estate investments without active involvement in day-to-day management.

How can I start earning passive income through real estate?

To start earning passive income through real estate, consider investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms that allow you to invest in real estate projects.

What types of properties are best for generating passive income?

Single-family homes, multi-family units, and commercial properties are popular choices for generating passive income, as they can provide steady rental income.

Do I need a lot of money to invest in real estate for passive income?

While having capital helps, there are options like real estate crowdfunding or partnering with other investors that allow you to start generating passive income with less upfront investment.

What are the risks associated with earning passive income in real estate?

Risks include property market fluctuations, tenant vacancies, maintenance costs, and potential legal issues, so it’s important to conduct thorough research and due diligence.

How can I minimize risks when investing in real estate for passive income?

To minimize risks, diversify your investments, choose properties in desirable locations, conduct regular maintenance, and consider hiring a property management company.