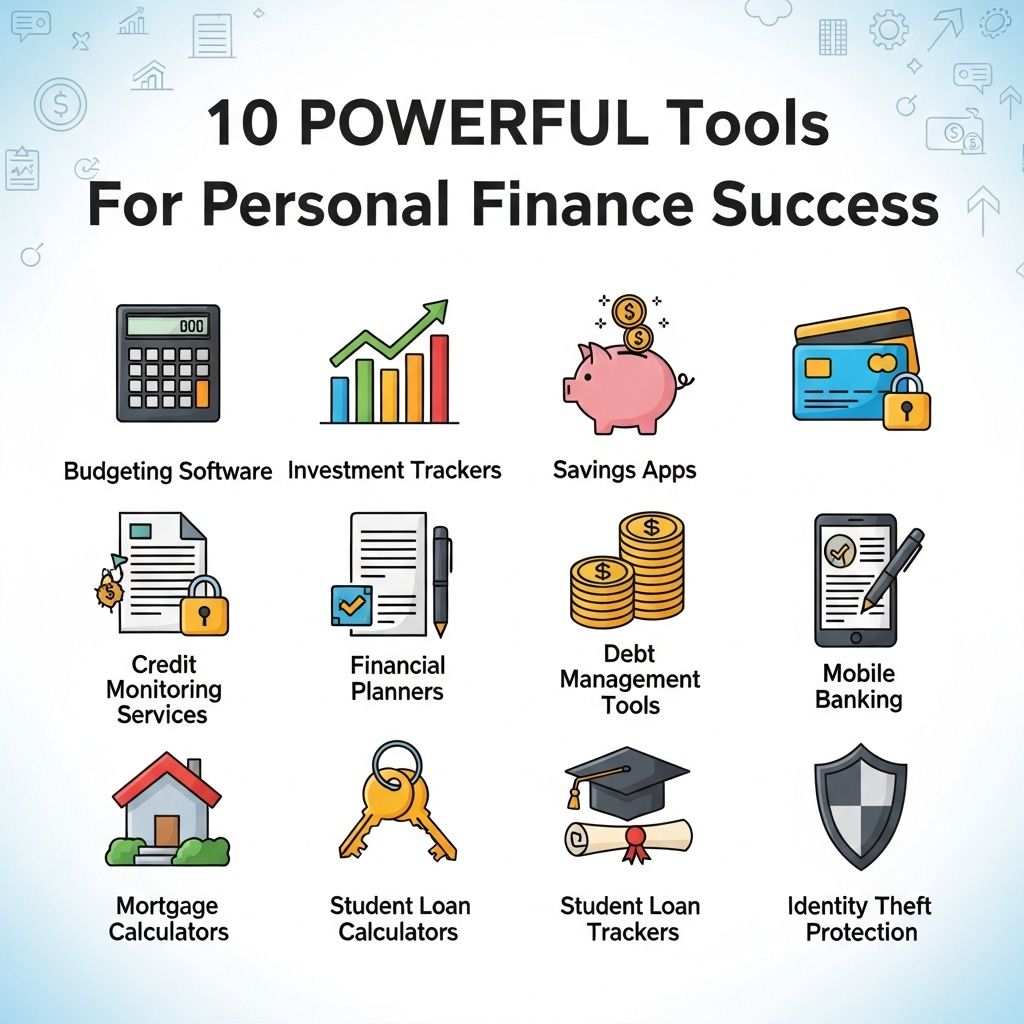

Managing personal finances can often feel like a daunting task, especially with the myriad of options available to help streamline budgeting, saving, and investing. Thankfully, technology has made it easier than ever to take control of your financial health. In this article, we will explore ten powerful tools that can assist you on your journey to personal finance success, enabling you to make informed decisions and achieve your financial goals.

In today’s fast-paced financial landscape, leveraging the right tools can significantly enhance your personal finance success. From budgeting apps to investment trackers, these resources empower you to manage your money effectively and make informed decisions. For instance, you can get insights on Facebook audience engagement to improve your financial communication strategies.

1. Budgeting Apps: The Foundation of Financial Management

One of the first steps in managing personal finances is budgeting. Budgeting apps can help individuals track their spending, set limits, and visualize their financial situation. Here are some top options:

- Mint: A comprehensive tool that aggregates all your accounts, helps you create a budget, and tracks your expenses.

- YNAB (You Need A Budget): Focuses on proactive budgeting by helping users allocate every dollar to its intended purpose.

- EveryDollar: A user-friendly app designed for zero-based budgeting, allowing you to plan where every dollar goes.

2. Expense Tracking: Understand Your Spending Habits

Expense tracking is crucial in identifying where your money goes each month. Knowing your spending habits can help you make necessary adjustments.

Popular Expense Tracking Tools

| Tool | Features | Price |

|---|---|---|

| Expensify | Receipt scanning, mileage tracking, expense reporting | Free with premium options |

| PocketGuard | Connects to bank accounts, shows available spending after bills and goals | Free with premium options |

| Spendee | Shared wallets for family or friends and budget planning | Free with premium options |

3. Investing Platforms: Grow Your Wealth

Investing is key to building long-term wealth. The following platforms offer unique features that cater to different types of investors:

Investment Tools Overview

- Robinhood: Commission-free trading with a user-friendly interface, ideal for beginners.

- Betterment: An automated investing service that utilizes robo-advisors to manage your portfolio.

- Fidelity: A well-established broker with extensive investment options and retirement accounts.

4. Savings Tools: Building an Emergency Fund

Having a savings cushion is essential for financial stability. Here are a few tools that can help boost your savings:

Top Savings Tools

| Tool | Features | Interest Rate |

|---|---|---|

| Ally Bank | High-yield savings account with no monthly fees | Up to 0.50% |

| Marcus by Goldman Sachs | No fees and competitive interest rates | Up to 0.50% |

| Chime | Automated savings features, round-ups from purchases | Up to 0.50% |

5. Credit Monitoring: Keep an Eye on Your Credit Score

Your credit score can significantly impact your financial opportunities. Credit monitoring tools can help you keep track of your score and identify any potential issues.

Reliable Credit Monitoring Services

- Credit Karma: Free access to your credit score and credit report.

- Experian: Provides credit monitoring and alerts for important changes.

- Credit Sesame: Offers credit score tracking and personalized tips for improvement.

6. Retirement Planning: Prepare for the Future

It’s never too early to start planning for retirement. The following tools can help you determine how much you need to save:

Retirement Planning Resources

| Tool | Features | Price |

|---|---|---|

| Personal Capital | Retirement planning calculator and investment tracking | Free with advisory services available |

| Fidelity Retirement Score | Personalized retirement score based on your savings | Free |

| SmartAsset | Calculators for various retirement scenarios | Free |

7. Financial Education: Knowledge is Power

Understanding financial concepts can empower you to make better decisions. Here are some platforms that offer excellent resources:

Educational Platforms for Financial Literacy

- Khan Academy: Offers free courses on personal finance and investing.

- Coursera: Provides online courses from top universities on various financial topics.

- Investopedia: A vast source of information and guides on finance and investing.

8. Tax Software: Simplify Your Tax Filing

Tax season can be overwhelming, but using the right software can smooth out the process.

Popular Tax Software Options

| Tool | Features | Price |

|---|---|---|

| TurboTax | Guided tax filing with maximum refund guarantee | Varies by plan |

| H&R Block | In-person support available, along with online filing | Varies by plan |

| TaxAct | Lower-priced alternative with all essential features | Varies by plan |

9. Bill Management: Stay on Top of Your Bills

Keeping track of monthly bills can be a hassle. Bill management tools can help ensure you never miss a payment.

Effective Bill Management Tools

- Truebill: Automatically tracks subscriptions and notifies you of upcoming bills.

- BillTracker: Simple app to manage and remind you of due dates.

- Prism: All-in-one bill management tool with due date alerts.

10. Financial Community: Learn from Others

Joining a community can provide support and additional resources in your personal finance journey. Online forums and social media groups can offer invaluable advice.

Engaging Financial Communities

- Reddit (r/personalfinance): A robust community discussing various finance topics.

- Facebook Groups: Look for groups focused on financial literacy and budgeting.

- Meetup: Find local finance-related events or meetups for networking.

Conclusion

Incorporating these powerful tools into your personal finance strategy can lead to significant improvements in your financial health. Whether it’s budgeting apps, investment platforms, or educational resources, leveraging technology enables you to make informed decisions. Start exploring these tools today and take charge of your financial future!

FAQ

What are the top tools for managing personal finance?

Some of the top tools for managing personal finance include budgeting apps like Mint and YNAB, investment platforms like Robinhood and Betterment, and expense tracking tools like PocketGuard.

How can budgeting apps help with personal finance?

Budgeting apps help users track their spending, create budgets, and set financial goals, making it easier to manage personal finances effectively.

Are investment platforms safe to use for personal finance?

Most investment platforms are regulated and implement security measures to protect user data, but it’s essential to research and choose reputable ones.

What is the importance of tracking expenses in personal finance?

Tracking expenses is crucial as it helps individuals understand their spending habits, identify areas to cut costs, and ultimately improve their financial health.

Can financial planning software help with long-term financial goals?

Yes, financial planning software can assist in setting, tracking, and achieving long-term financial goals by providing insights and projections based on current financial data.

How do financial calculators aid in personal finance?

Financial calculators help users estimate loan payments, retirement savings, and investment growth, providing valuable information for making informed financial decisions.