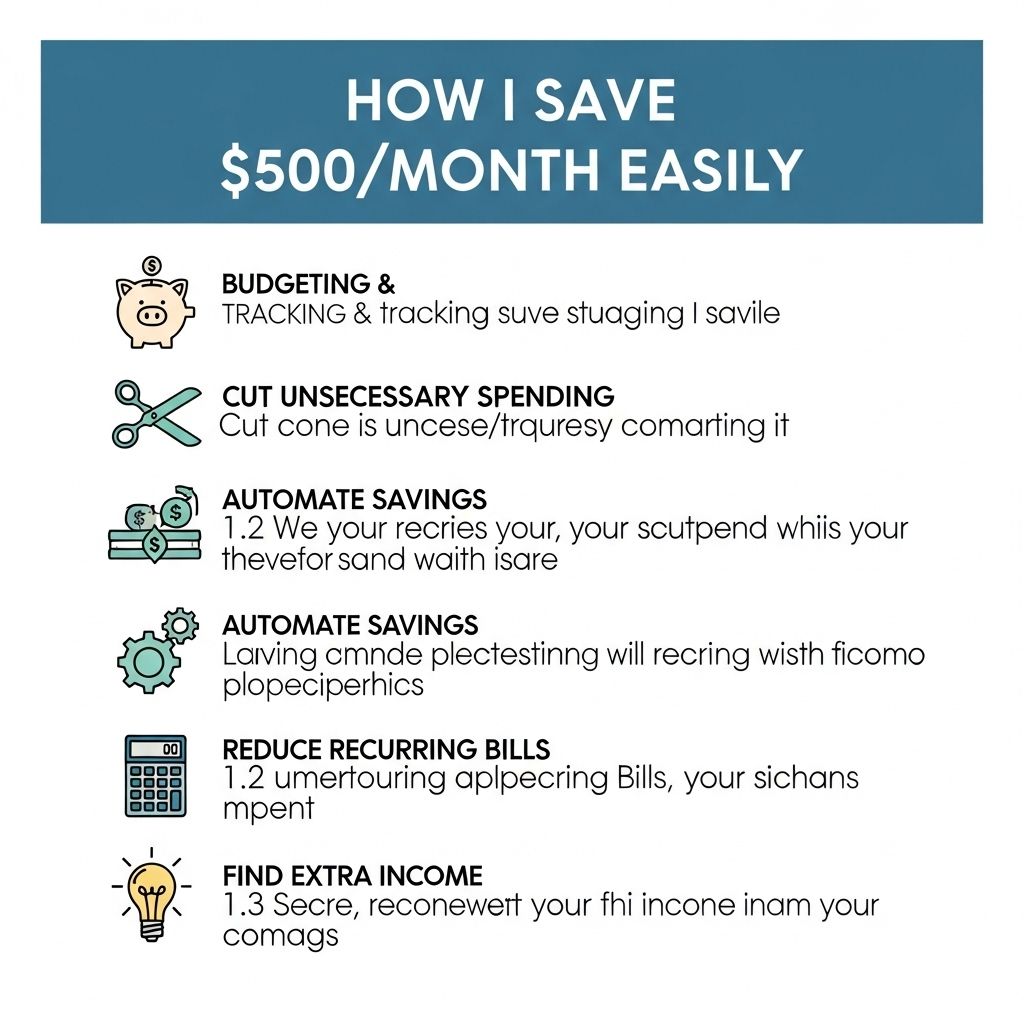

In today’s fast-paced world, managing finances effectively can be a challenge. However, achieving a savings goal of $500 per month is not only possible but can be done with a systematic approach. Whether you’re looking to build an emergency fund, save for a vacation, or pay off debt, understanding where to cut back and how to make the most of your income is key. This article will delve into practical strategies to help you save money effortlessly each month.

Looking to boost your savings by $500 a month? Implementing simple budgeting strategies and small lifestyle changes can significantly impact your finances. For instance, consider creating personalized greeting cards instead of buying expensive ones, which can help you save while adding a personal touch to your celebrations; check out this personalized greeting card for some creative inspiration.

Assess Your Current Financial Situation

The first step in your saving journey is to take a thorough look at your current financial situation. This involves understanding your income, expenses, and spending habits.

Calculate Monthly Income

Start by calculating your total monthly income. Include all sources of income such as:

- Salary

- Side hustles

- Investment income

- Any other sources

Track Your Expenses

Next, you need to track your monthly expenses. This will help you see where your money is going. Consider categorizing your expenses into fixed and variable:

| Type | Examples | Monthly Amount |

|---|---|---|

| Fixed | Rent, utilities, insurance | $X |

| Variable | Groceries, entertainment, dining out | $Y |

Creating a Budget

Once you have a clear picture of your income and expenses, it’s time to create a budget. A budget will act as a financial roadmap guiding your spending and helping you achieve your savings goal.

50/30/20 Rule

A popular budgeting method is the 50/30/20 rule, which suggests dividing your income as follows:

- 50% for needs (essentials)

- 30% for wants (discretionary spending)

- 20% for savings and debt repayment

Reducing Expenses

To reach your $500 savings target, you may need to reduce certain expenses. Here are some effective strategies:

Identify Unnecessary Subscriptions

Review your subscriptions and memberships. You might find:

- Streaming services

- Gym memberships

- Magazine subscriptions

- Apps and software

Cancelling even a couple of these can free up significant funds.

Cutting Down on Dining Out

Dining out can quickly eat into your budget. To save, consider:

- Cooking at home more often

- Meal prepping for the week

- Planning special meals rather than spontaneous outings

Grocery Shopping Smartly

Groceries are another area where savings can be made:

- Create a shopping list to avoid impulse buys.

- Use coupons or cashback apps.

- Buy seasonal produce and store brands.

Increasing Income

In addition to cutting expenses, consider ways to increase your income to help reach your savings goal.

Gain New Skills

Invest in yourself by learning new skills. This can lead to better job opportunities and potentially higher pay.

Side Hustles

Taking on a side job can significantly bolster your monthly earnings. Popular options include:

- Freelancing (writing, graphic design, consulting)

- Driving for rideshare services

- Online tutoring or teaching

- Pet sitting or dog walking

Automating Your Savings

Consider setting up an automatic transfer to your savings account. This way, as soon as you receive your paycheck:

- Determine an amount to save each month.

- Set up an automatic transfer to your savings account.

This method helps you save without needing to think about it actively.

Utilizing Savings Tools

There are numerous apps and tools designed to help you save money. Consider using:

- Budgeting apps like Mint or YNAB (You Need A Budget)

- Savings apps like Acorns or Digit

- Cashback apps such as Rakuten or Ibotta

Evaluating Financial Products

Shop around for the best financial products. Consider looking for:

- High-yield savings accounts

- Credit cards with rewards or cash back

- Investment accounts with low fees

Monitoring Your Progress

Track your savings progress regularly to stay motivated. Here’s how:

- Set monthly check-ins to review your budget.

- Adjust your budget as necessary based on actual spending.

- Celebrate milestones to keep you motivated!

Final Thoughts

Saving $500 a month may seem daunting, but with careful planning and discipline, it’s entirely achievable. By assessing your current finances, creating a budget, reducing your expenses, and possibly increasing your income, you can easily meet your savings goals. Remember to stay committed to your plan, track your progress, and adjust as needed.

With perseverance and conscious financial choices, you can create a secure financial future for yourself.

FAQ

How can I save $500 a month easily?

Start by creating a budget to track your expenses, identify non-essential spending, and set savings goals. Cut back on dining out, subscriptions, and impulse purchases.

What are some effective budgeting tips to save money?

Use the 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings. This helps prioritize your finances and ensures you save consistently.

Are there specific apps that can help me save money?

Yes, popular budgeting apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you track spending, set savings goals, and manage your budget effectively.

How can I reduce my monthly expenses to save more?

Consider negotiating bills, shopping for better insurance rates, cooking at home instead of eating out, and canceling unused subscriptions to reduce monthly expenses.

What are some creative ways to save extra money?

Try automating your savings, setting up a side hustle, or selling unused items around your home. Small changes can add up to significant savings over time.

Can saving $500 a month make a difference in my finances?

Absolutely! Saving $500 a month can lead to $6,000 a year, which can build an emergency fund, pay off debt, or be invested for future growth.