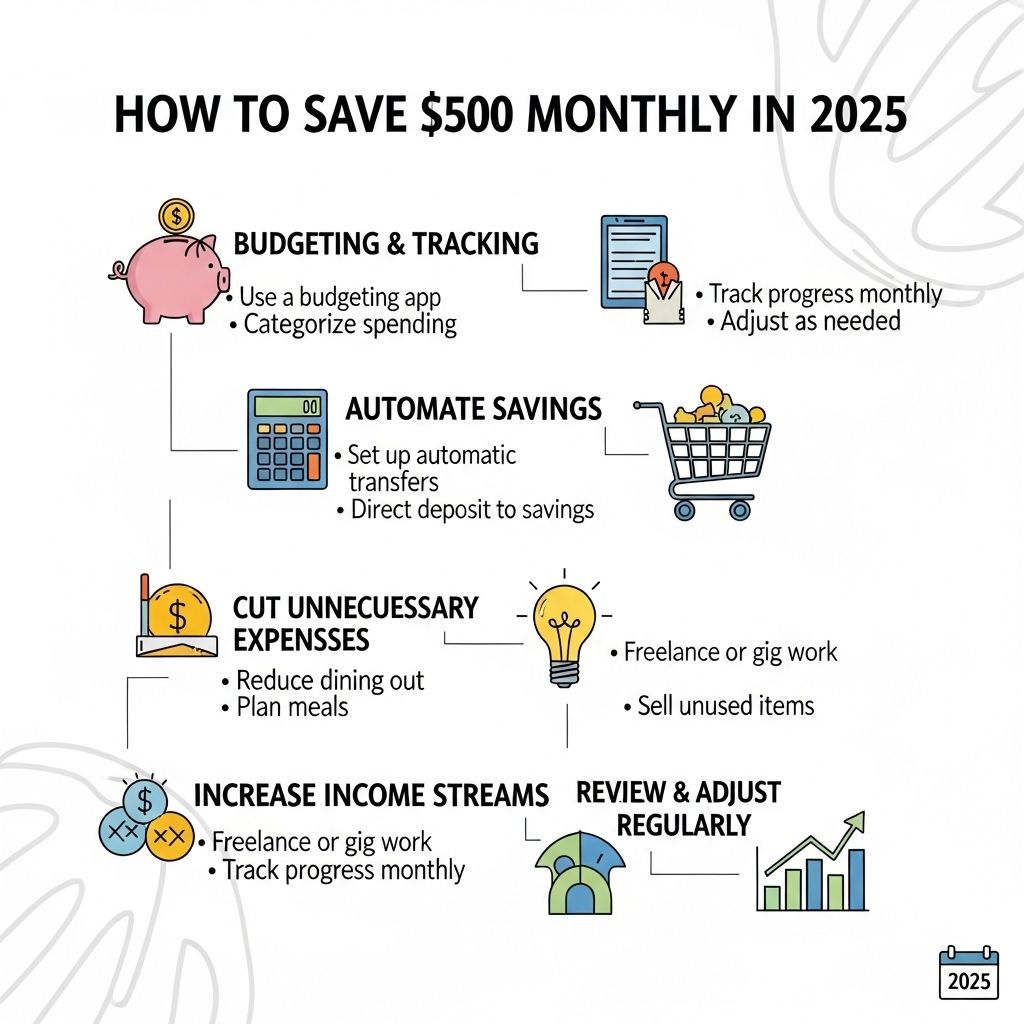

In today’s fast-paced world, saving money has become more crucial than ever. With rising costs and economic uncertainties, having a financial cushion can provide peace of mind and security. Setting a goal to save $500 monthly not only fosters discipline but also helps in achieving long-term financial objectives. This article will explore various strategies and tips to help you reach this savings milestone by 2025.

As we navigate the financial landscape of 2025, employing smart strategies to save $500 monthly can significantly enhance our economic resilience. From meticulous budgeting to leveraging technology for automatic savings, there are numerous practical methods to align our expenses with financial goals. For those exploring avenues to invest in creative ventures, check out these best ice cream mockup templates that can inspire entrepreneurship while keeping costs manageable.

Understanding Your Financial Landscape

Before diving into savings strategies, it’s essential to assess your current financial situation. Understanding where your money goes is the first step toward effective saving. Here are key areas to focus on:

1. Track Your Income and Expenses

Begin by creating a detailed budget:

- Income: List all sources of income.

- Fixed Expenses: Include rent/mortgage, utilities, and insurance.

- Variable Expenses: Account for groceries, entertainment, and discretionary spending.

2. Calculate Your Savings Rate

Determine what percentage of your income you’re currently saving. The general recommendation is to save at least 20% of your income. If you’re not meeting this target, assess how to bridge the gap.

Setting Up Your Savings Plan

Once you have a clear picture of your finances, you can craft a plan tailored to your needs and goals. Here are steps to create an effective savings plan:

1. Define Your Objectives

What do you want to achieve with your savings? This could be:

- Emergency fund

- Vacation

- Home purchase

- Retirement savings

2. Open a Dedicated Savings Account

Consider opening a high-yield savings account specifically for your savings goals. This helps separate your savings from everyday spending.

Strategies to Cut Costs

To free up $500 each month, you may need to make adjustments in your spending habits. Here are some effective strategies:

1. Evaluate Subscription Services

Examine monthly subscriptions and identify any that you can cancel:

| Subscription Type | Cost | Frequency |

|---|---|---|

| Streaming Services | $15 | Monthly |

| Magazine Subscriptions | $5 | Monthly |

| Gym Membership | $30 | Monthly |

| Total | $50 |

2. Meal Planning and Grocery Shopping

Food expenses can add up quickly. Implement these strategies:

- Create a meal plan for the week.

- Make a grocery list before shopping to avoid impulse buys.

- Buy in bulk when possible to save money.

3. Limit Dining Out

Eating out frequently can derail your savings goals. Try these tips:

- Set a monthly limit on dining out.

- Choose one meal a week to enjoy at a restaurant.

- Prepare homemade meals and pack lunches.

Increasing Your Income

While cutting costs is vital, increasing your income can significantly contribute to your savings goal. Here are some options to consider:

1. Seek Additional Work

Look for part-time work, freelancing, or gig economy jobs that fit your schedule.

2. Invest in Yourself

Consider taking courses or certifications that could lead to a promotion or a better-paying job.

3. Sell Unused Items

Declutter your space and sell items you no longer need:

- Use platforms like eBay, Facebook Marketplace, or local consignment shops.

- Consider a garage sale for larger quantities of items.

Staying Motivated

Saving money can sometimes feel daunting. Here are tips to keep you motivated:

1. Set Milestones

Break down your $500 monthly savings into smaller, achievable goals:

- Save $125 weekly.

- Track progress and celebrate small victories.

2. Visualize Your Goals

Have a clear picture of what you’re saving for, whether it’s a vacation, a car, or a home. Keep images or reminders visible to motivate you.

3. Reassess Regularly

Check your budget and savings plan every few months. Adjust as needed to ensure you’re on track.

Conclusion

Saving $500 each month is certainly within reach with careful planning and commitment. By understanding your financial landscape, implementing cost-cutting measures, exploring income opportunities, and maintaining motivation, you can build a robust savings habit that secures your financial future. Start today, and make 2025 the year you achieve your savings goals!

FAQ

What are effective strategies to save $500 monthly in 2025?

To save $500 monthly in 2025, create a budget, cut unnecessary expenses, automate savings, consider side hustle opportunities, and regularly review your financial goals.

Is it realistic to save $500 a month?

Yes, saving $500 a month is realistic for many people, especially with careful budgeting and lifestyle adjustments.

What tools can help me track my savings in 2025?

Use budgeting apps like Mint, YNAB, or personal finance spreadsheets to track your savings and expenses in 2025.

How can I increase my income to save more money?

Consider freelancing, part-time jobs, or monetizing hobbies to increase your income and boost your savings.

What are some common expenses I can reduce to save $500 a month?

Look into reducing dining out, subscription services, and impulse purchases to help save $500 monthly.

How can I stay motivated to save consistently?

Set clear savings goals, celebrate milestones, and visualize your financial future to stay motivated in your saving journey.